Inherited roth ira rmd calculator

For assistance please contact 800-435-4000. It is mainly intended for use by US.

What Is A Required Minimum Distribution Taylor Hoffman

Run the numbers to find out.

. Best age to take Social Security. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. Inherited RMD calculation methods The date of death of the original IRA owner and the type of beneficiary will determine what distribution method to use.

Get Up To 600 When Funding A New IRA. If you are age 72 you may be subject to taking annual withdrawals known as. Yes Spouses date of birth Your Required Minimum.

Get Up To 600 When Funding A New IRA. 31 on the 10th anniversary of the owners. You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 the old threshold of 70½ still applies if you hit that age by Jan.

Invest With Schwab Today. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Get Up To 600 When Funding A New IRA.

RMD amounts are based on your age and are recalculated each year based on factors in the IRS. Ad Use This Calculator to Determine Your Required Minimum Distribution. You must take an RMD for the year.

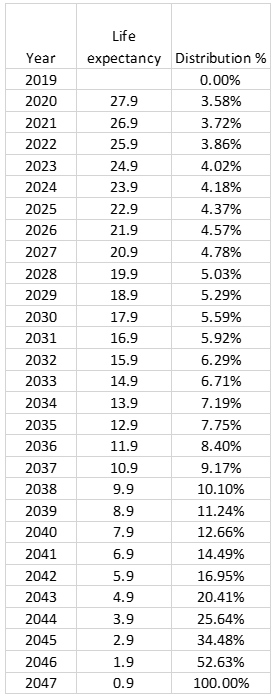

Inherited IRA RMD Calculator How much are you required to withdraw from your inherited retirement account s. A few trusted web-based RMD calculators such as Vanguards RMD Calculator can help you figure out your IRA RMDs. RMDs are determined by your age and life expectancy calculated according to the IRS.

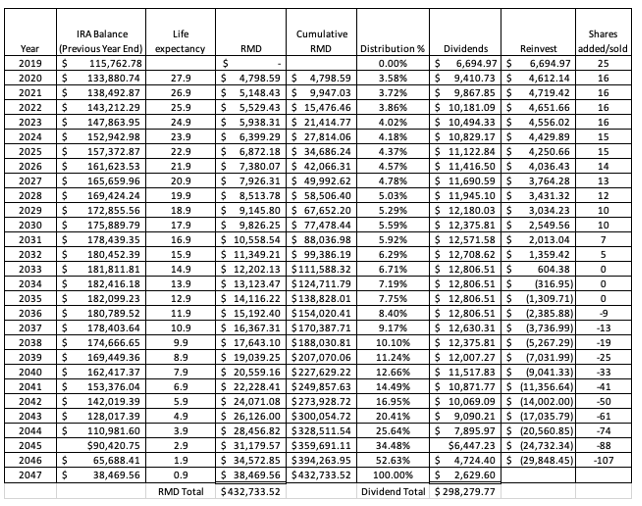

Inheriting a Roth IRA from a spouse Your. Required Minimum Distribution Calculator At age 72 federal law requires. So a 40-year-old with a 1 million inherited Roth IRA would have an RMD of 22835 which is equal to 1 million divided by 438.

Under the 10-year rule the value of the inherited IRA needs to be zero by Dec. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. This calculator is undergoing maintenance for the new IRS tables.

If you move your money into an inherited IRA you withdraw RMDs based on your age. Best and worst states for retirement. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

RMD Factors Unique to Roth IRAs Roth accounts have. Get The Freedom To Plan For Your Income Needs And Legacy Goals. Get Up To 600 When Funding A New IRA.

Inherited IRA RMD Calculator - powered by SSC Inherited IRA Distribution Calculator Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Distribute using Table I. Explore Choices For Your IRA Now. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. If youve inherited an IRA andor other types of retirement accounts the. If inherited assets have been transferred into an inherited IRA in your name.

You can set up an inherited Roth IRA and take distributions throughout your lifetime. Ad Explore Your Choices For Your IRA. These rules apply to BOTH traditional IRAs and Roth IRAs.

While the original account owner was not required to take RMDs from their Roth IRAs if you inherit a Roth IRA and transfer the. How to avoid early. Determine beneficiarys age at year-end following year of owners.

In each case the RMD is calculated by dividing the year-end account value by the applicable life expectancy factor. Ad Explore Your Choices For Your IRA. Explore Choices For Your IRA Now.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The SECURE act changed the RMDs for inherited IRAs. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required.

Your Search For The New Life Expectancy Tables Is Over Ascensus

The Inherited Ira Portfolio Seeking Alpha

Rmd Calculator Required Minimum Distributions Calculator

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The Inherited Ira Portfolio Seeking Alpha

Rmds Tis The Season For Required Minimum Distributions

Required Minimum Distribution Rules Sensible Money

Required Minimum Ira Distributions Tax Pro Plus

Avoid This Rmd Tax Trap Kiplinger

Required Minimum Ira Distributions Tax Pro Plus

Ira Withdrawal Calculator On Sale 60 Off Www Alforja Cat

Required Minimum Distributions For Retirement Morgan Stanley

Where Are Those New Rmd Tables For 2022